The single greatest edge an investor can have is a long-term orientation. – Seth Klarman

Fundamentals versus Emotions

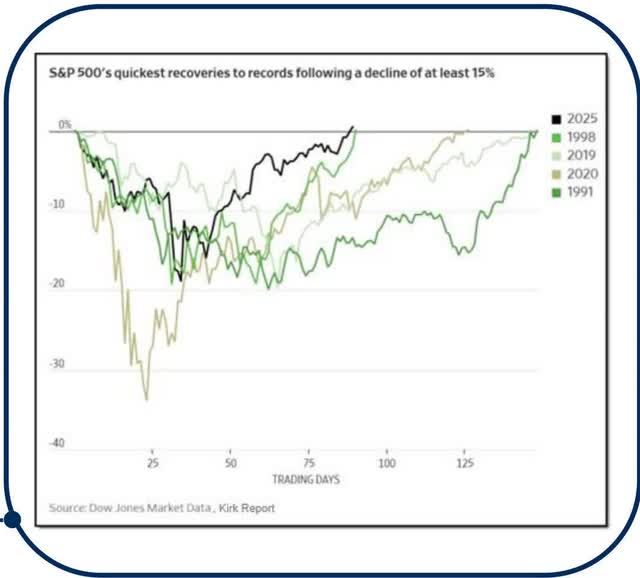

The quote at the beginning of our last newsletter in the Spring came from Bill Miller who stated, “Great investors are not unemotional, but are inversely emotional – they get worried when the market is up and feel good when everyone is worried.” When we published our Spring Investor Letter it was two trading days from the market’s April 8 low. We wrote that during the first quarter pullback the market may react less on fundamentals and that was certainly the case. The S&P 500 Index (SP500, SPX) erased the 19% decline in a record 55 trading days, the fastest recovery to a record high ever. As noted by Ned Davis Research, “The index ended Q2 with a gain of 10.6%, its best quarter since Q4 2023 and the eleventh-best quarterly return in 25 years.”

A couple of factors are contributing to a favorable recovery in U.S equities with an important one being positive earnings results. In the fourth quarter of 2024 and first quarter of this year, actual earnings results exceeded analyst expectations. According to FactSet the estimated earnings growth rate for Q2 2025 is 9.4%. Although this growth rate is lower than expectations earlier in the year due to concerns about tariffs and inflation, recent reports show more companies are reporting earnings for Q2 2025 that are exceeding expectations than the historical average. The other factor contributing to positive equity market returns is the impact, or lack thereof, that tariffs seem to be having on the economy. Torsten Sløk, chief economist at Apollo Global Management, was strongly against the tariffs earlier this year saying they could lead to a recession. However, in a recently published comment by Sløk, he notes,

Maybe the strategy is to maintain 30% tariffs on China and 10% tariffs on all other countries and then give all countries 12 months to lower non-tariff barriers and open up their economies to trade. Extending the deadline one year would give countries and US domestic businesses time to adjust to the new world with permanently higher tariffs, and it would also result in an immediate decline in uncertainty, which would be positive for business planning, employment, and financial markets. This would seem like a victory for the world and yet would produce 400$ billion of annual revenue for US taxpayers. Trade partners will be happy with only 10% tariffs and US tax revenue will go up. Maybe the administration has outsmarted all of us.

In short, many countries the U.S. does business with maintain tariffs on U.S. products. Maybe the Trump administration’s approach will simply bring the U.S. position into more of a balanced one without contributing to ongoing sustained inflation.

The U.S. Dollar and International Market Return

Early expectations surrounding the Trump administration’s economic policy suggested that tariffs would raise the cost of imported goods, thereby reducing U.S. consumer demand for foreign products. Simultaneously, tax cuts were anticipated to stimulate domestic growth by encouraging investment and spending, factors typically associated with a strengthening U.S. dollar. However, actual economic performance has been mixed, and the passage of the One Big Beautiful Bill Act has introduced concerns about prolonged budget deficits. As a result, the dollar has weakened, declining approximately 10% year-to-date.

In addition, a weakening U.S. dollar can improve the performance of international investments for U.S. investors. When the dollar depreciates relative to foreign currencies, the value of overseas assets, such as international stocks and bonds, tend to rise when converted back into dollars. This currency effect can enhance returns on foreign holdings, providing a natural hedge against potential economic uncertainty in the U.S. As global investors diversify away from U.S. assets due to concerns over trade policy and fiscal concerns, international markets may become more attractive, further boosting the appeal of international investments for investors domiciled in the U.S.

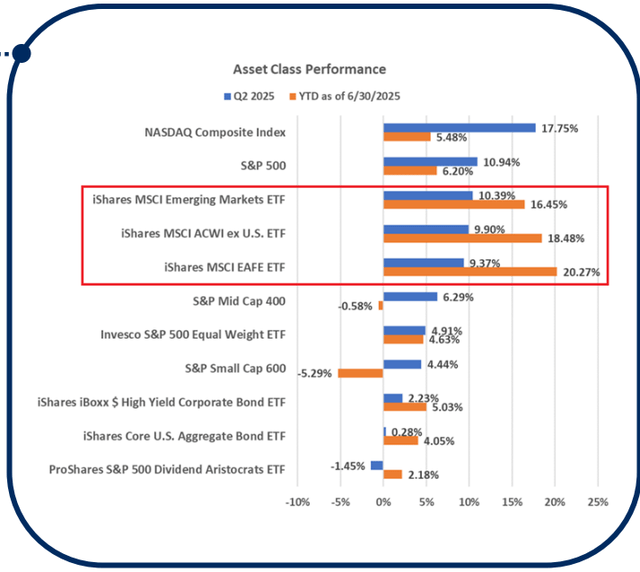

The nearby bar chart illustrates performance across several asset classes for the second quarter of 2025 and year-to-date through June 30, 2025. The three indices highlighted within the red square represent international asset classes. The rust-colored bars show year-to-date returns, where international benchmarks have notably outperformed other asset classes on the chart. In contrast, the blue bars represent second-quarter returns, with U.S. categories, especially those at the top of the chart, outperforming their international counterparts. This pattern indicates that international assets led in the first quarter, while U.S. assets gained relative strength in the second quarter.

Government Debt

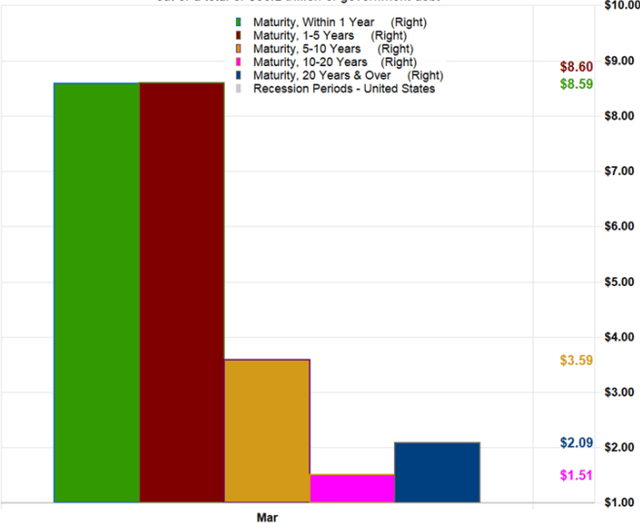

With the recent passage of the One Big Beautiful Bill Act, from an initial take of the Act, the tax cuts that would have expired at the end of this year have been extended. Not addressed in the OBBBA is the issue of the budget deficit. A point of view being expressed by some is stronger economic growth might generate higher tax revenue. Without opining on this likelihood, one aspect of the budget is the fact the budget deficit continues to run about 2 trillion. Additionally, nearly 47 % of the government′s Public Debt held in private investors portfolios comes due in five years or less. The amount of debt maturing within a year totals $8.6 trillion. Much of this maturing debt is at lower interest rates so rolling over the debt, along with new issuance, will put pressure on the budget as interest expense increases.

Additionally, as supply increases, bond prices fall and the yield on newly issued debt will rise. As noted earlier, this higher debt level is contributing to the weakness of the U.S. Dollar.

Improving Sentiment

Generally, investor sentiment has been improving after falling in the run up to the Trump administration’s tariff announcement in early April.

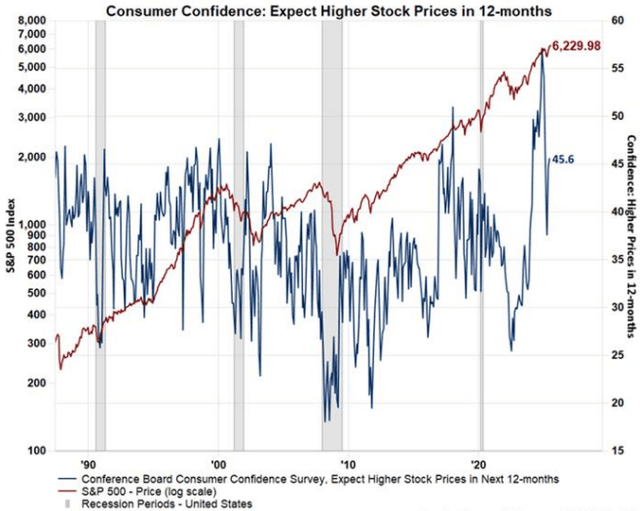

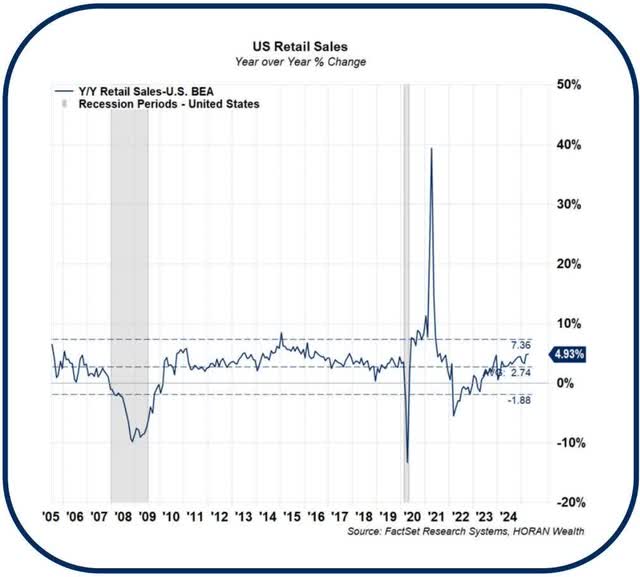

As the chart shows, the Conference Board’s reading on consumer’s expectations on stock prices shows 45.6% expect higher stock prices over the next 12 months. This is up from 37.6% in April. The current reading of 45.6% places it near the higher end of the reading’s longterm range. This higher confidence level is showing up in other measures and likely contributing to an improving trend in retail sales.

Worth keeping in mind though is the fact sentiment measures are mostly contrarian indicators, i.e., investors often become more positive near market highs. This relates to the Warren Buffett quote, “be fearful when others are greedy and greedy when others are fearful.” Just as consumers’ expectations about future stock prices is not at an extreme, the American Association of Individual Investors’ Sentiment Survey shows elevated bullishness, but again, not at an extreme.

Conclusion

The long-forecasted recession predicted in recent years has not materialized and the resiliency of the U.S. economy has played out once again. The strength of the U.S. consumer has continued to be supported by low unemployment and firm housing prices. While we see signs of some downsizing, the unemployment rate continues to be quite low. Corporate America continues to contribute healthy earnings growth and is generally in solid financial shape. The potential of Artificial Intelligence advancement is providing excitement for future opportunities. The markets continue to keep a keen eye on the economy’s path and the potential interest rate trajectory. The overall inflation pressures seem to be abating, which should allow the Federal Reserve to reduce short term interest rates somewhat. With the deficit issues outlined above, longer term interest rates may not fall and could indeed rise. More certainty around tax policy after the passage of OBBBA and tariff issues beginning to be resolved could provide a more stable outlook for corporate and individual capital investment.

Thank you for your continued confidence and support in HORAN Wealth and we are always available to answer your questions and discuss our outlook further. Please be sure to visit us for company news, reports, and our blog at Insights.

Read the full article here