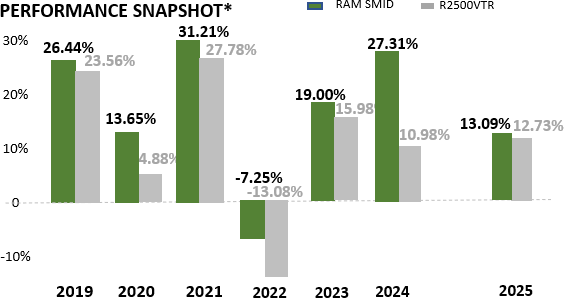

The RAM Smid composite gained 3.58% in 4Q25, outperforming the Russell 2500 Value Total Return index which rose 3.15%. Year to date, the RAM Smid composite gained 13.09% vs. 12.73% for the Russell 2500 Value Total Return index.

Overall, 2025 was another strong year for equities. Large-cap stocks led much of the year, driven by AI and technology, but momentum shifted late in the year. In 4Q25, both the Russell 2500 Value and Russell 2000 Value outperformed the S&P 500 and Nasdaq Composite.

We view this small cap outperformance in 4Q25 as an early sign of investors rebalancing their portfolios and broadening their holdings away from the large-cap indices. We remain optimistic about the Smid value sector heading into 2026.1,2,3

Source: Rewey Asset Management, Index returns sourced from Bloomberg 12/31/2025.

*Note that there are material limitations inherent in any comparison between RAM Smid strategy and the R2500 Value Total Return Index. The R2500 Value Total Return Index is unmanaged, and you cannot invest directly in an index. The RAM portfolio is actively managed and holds concentrated investments in the equity securities of small-mid capitalized companies. Please see important disclosures at the end of this letter.

A Strengthening Economy – Set to Continue

Amazingly, the U.S. economy strengthened into year-end, recovering from 1Q25 weakness that we believe was caused by tariff fears. GDP fell 0.6% in 1Q25 but recovered to 3.8% and 4.3% in 3Q25 and 4Q25, respectively.4

We believe the economy can remain strong into 2026. We think the rapid increase of 525 basis points in the Fed Funds rate in 2022-2023 pressured financing dependent cyclical industries including credit cards, auto lending, capital equipment purchases, health care equipment, etc. The combined cuts of 175 bps over the last 15 months could likely re-spark growth in these areas.

We think consumer spending looks to remain healthy in 2026 as well. Consumer spending was the strongest part of 3Q25’s GDP print. While much of the strength has been from higher end consumers, there are several tailwinds geared towards the lower end consumer that could benefit 2026 under the Big Beautiful Bill. These include increased standard deductions, higher SALT deduction levels, auto loan deductibility, no tax on tips and even some increased child-care credits. We also could see even more low-end consumer stimulus announced, either in healthcare or tax rebate checks in 2026 as affordability is now a leading economic issue in the mid-term elections.

Stubbornly high inflation, too, looks to us like it could ebb in 2H26. The core PCE, the Fed’s preferred measure of inflation, was 2.9% in 3Q25, still above the Fed’s neutral rate target of 2%. Imported goods account for roughly 14% of GDP. The impact of tariffs on this 14% is hard to determine, with differing rates and selective exclusions, but if we estimate an average 15% tariff, this would equate to over a 2% impact of inflation in GDP. This impact should start to fade starting in late 2Q26, as the one-time price increase of tariffs reach their anniversary.5

The Fed Might Have to Cut More Than It Would Like

We wrote in our 3Q25 letter about the dual mandate of the Fed that is enshrined by the 1977 Federal Reserve Act. Under this mandate, the Fed must consider jobs, as well as inflation, as it sets interest rates. Jobs, measured by non-farm payrolls, continue to deteriorate, down 105,000 in October. The unemployment rate also rose to 4.6%, the highest level since September 30, 2021.6

We suspect that a good portion of this job weakness is from the early adoption of AI. While we have not seen widespread AI-driven layoffs, anecdotally we have heard some companies are choosing not to backfill open roles and slow new hiring due to productivity gains from AI. We think that while the impact of AI on earnings at companies will be positive, due to cost savings, we think AI could very well be a sustained negative headwind for the labor market.

If job growth stays weak, we think the Fed could likely cut rates again, and if tariff driven inflation does ease, we think the likelihood of more cuts improves dramatically.

Are Large Cap Tech Stocks Too Extended?

Investors are beginning to ask the appropriate questions of the large-cap tech space, such as are the total addressable market forecasts too optimistic? How long will the period of competitive advantage for these technologies last? And most importantly, do the valuation metrics allow for an acceptable investor return on capital, or even a full return of capital?

In contrast, we believe the small cap value sector remains attractively valued, and neglected by investors who do not fully appreciate impact of a continued strong GDP environment, investment tax credits under the big beautiful bill, and the positive impact of lower Fed rates. We believe the small cap sector has been suffocated by the large cap tech giants. A plateauing of large caps, as investors seek answers to profitability questions, could lead investors to broaden their holdings into the smaller cap universe.

The Implications of Liquidity on Rotation

If a broadening begins, it could rapidly turn into a stampede. If investors sold just 1% of the S&P 500 and reinvested it into the Russell 2500 value index, they would have to buy approximately 10% of that index. If it were allocated to the smaller cap Russell 2000 value index, this would represent buying just under 30% of that index. The valuation differentials in these indices, too, in our view have moved to extremes. The 2026 Bloomberg PE estimated for the S&P 500 is 23.56x, is 31.16x for the Mag 7 ETF, while only 15.69x and 14.11x for the Russell 2500 value and Russell 2000 value, respectively.7,8

While the move to smaller caps could be powerful, we do not think ETFs are the way to invest down cap, both due to the large number of negative earnings and negative cash flow companies in these indexes, and the lack of thorough sell-side research on these smaller companies. We think an active approach, conducted with independent research and due diligence, can provide for superior returns than the small cap indices.

Portfolio Highlights

We added three new positions in 4Q25 and while we reduced some positions, we did not sell any positions to zero. We note that both CADE and HOLX both agreed to be acquired, with the deals pending closure in 2026. We believe both deals will close and elected to hold the positions into the close, as there is likely upside for each. Although the name count is now thirty-three positions, we still believe it will average 25-30 positions over the long term.

At quarter end, the combined weight of our top ten holdings was 45.3%. Cash was 4.3% of the portfolio. While we continue to search for, and find, stocks that fit our investment philosophy, we also very much like the composition of our current portfolio and are believers in the benefits of long-term compounding with modest portfolio turnover.

Eight of our composite holdings had net cash on the balance sheet and only three positions had a debt/EBITDA ratio over 3x, including our two utilities. Sixteen holdings were trading at less than 1.5x book value.9

Mayville Engineering (MEC)

MEC was our top 4Q25 performer, rising 34.8%. Shares rallied as investors began to look past 2025 cyclical sales weakness and envision the potential sales strength a 2026-2027 recovery could bring. The stock also benefited from enthusiasm around the Accu-Fab acquisition, which opened the data-center equipment market to MEC. While we remain positive on the company’s long-term prospects, we expect the cyclical recovery in its agriculture, truck, and consumer recreational end markets to be gradual and uneven. As a result, we modestly trimmed our position.10

Lakeland Industries (LAKE)

LAKE was our weakest performer in 4Q25, declining 45.31%. We had reduced our position ahead of its FY3Q26 report, as we thought there could be some weaknesses in sales and merger integration. While results were weaker than expected, we believe the share price decline was an overreaction, amplified by year-end tax-loss selling. LAKE retains a strong balance sheet, and we see a clear path to revenue growth in the global fire protection market through both organic initiatives and acquisitions. We also note that following the quarter a new holder filed a 13D and now owns 8.38% of the shares.11

Donnelley Financial Solutions (DFIN)

We initiated a position in Donnelley Financial Solutions (DFIN), a provider of capital markets and compliance-related technology solutions. We believe significant, but positive, changes in the business model have reduced investor visibility leading to investor neglect and undervaluation of the shares. DFIN is in the mid-stages of transitioning to a software-as-a-service model for corporate governance reporting, mergers and acquisitions filings and initial public offering registrations. While the metrics of software solutions continued to improve in 3Q25, results were obscured by one-time charges to terminate the company’s pension plan, which strengthened the balance sheet, and the 4Q25 impact of the government shutdown, which paused, but likely did not cancel, M&A and IPO activity.

DFIN maintains a strong balance sheet and generates substantial free cash flow. Donnelley’s 2025(e) debt-to-EBITDA ratio is a low .6x, and trailing twelve-month EBITDA covers interest expense by over 20x. In March, the company renewed its credit facility, extending the maturities of its Term Loan A and revolver to 2030. At 3Q25 it has only $43 million drawn on its $300 million revolver. We see the positive free cash flow and balance sheet strength as providing plenty of stability for DFIN as the transition to software revenues continues. This strength also allows DFIN to repurchase its own shares, with $35.5 million and $111.6 million in buybacks for 3Q25 and YTD25, respectively.

We think investors are misinterpreting the transition away from printed and mailed filings as it shifts towards software solutions. Its offerings for SEC disclosure, board governance, compliance, merger filings, and IPO listings remain mission critical for customers. In 3Q25 software solutions revenue grew 10%, led by the less cyclical compliance solutions segment which grew 16%. Gross margin expanded to 62.7% reflecting the higher profitability and lower cost structure of the software model, despite a slowdown in cyclical transactional revenues, down 4%.

We also believe investors should lengthen their time horizon and look through muted 4Q25 revenue guidance which built in the negative impact of the government shutdown. While M&A approvals and initial filings were delayed, we believe that filings should resume and even accelerate into late 4Q25. Moreover, we expect a cyclical uptick in M&A and IPO filings in 2026, supported by a resilient economy and lower interest rates.

We think DFIN’s shares are very attractively valued. Shares closed the year at $46.69 per share, down 25.6% YTD and down 33.2% from their 52-week high of $69.92 on 2/6/25. Shares trade at only 10.5x 2026 EPS and 5.6x EBITDA estimates, both near the lower end of traditional ranges, and significantly below peers, such as Broadridge (BR) which trades at multiples of 24.1x and 16.7x, respectively. This valuation disparity is what we see as another example of the large cap vs. small cap valuation opportunities in general, as DFIN’s market value is only $1.2 billion vs. BR at $26.6 billion.

We have conservatively set our price target at $66, up 41.4% from year end closing low, implying only a 15x EPS multiple, and a level still roughly 5% under its 52-week high. Over time, as investors gain clarity on DFIN’s more stable, software-driven revenue model, and if the company continues to show revenue and margin improvement, amplified by a likely near-term cyclical boost in 2026 vs. 2025, we think the shares have the potential to exceed this conservative target.12

Looking Forward

As we enter 2026, the market faces a new set of uncertainties, including the possibility of a second government shutdown, election-year political headlines, a change in the Fed Chair, and ongoing geopolitical tensions involving Russia, Ukraine, Taiwan, China and Venezuela. But we also note that one of the only certainties we have found in the markets over our 34 years of investing is that the market will always face uncertainties and unexpected shocks. Our investment philosophy reflects this reality: we focus on financially strong companies that can withstand periods of volatility and have a clear plan for value creation over the next 2–3 years. A robust, long-term investment case allows time to work as an ally and can provide opportunities to purchase securities at attractive valuations.

Looking past the uncertainties, we see several potential catalysts for the small and smid cap sector into 2026, including continued moderate GDP growth, moderating inflation and potentially more Fed rate cuts and, perhaps most importantly, a general neglect of the sector that has left many companies at attractive valuation levels.

We appreciate your trust and support. As always, please feel free to contact us to discuss our commentary or to share your thoughts.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here